As the business grows and the variety of accounting employees will increase it’s impractical to have just one ledger. In these circumstances it just isn’t uncommon to separate off sections of the primary ledger into separate subledgers. Notice that the stability of the Income Summary account is definitely the net income for the interval.

Checkbook Balancing Classes

The laptop and financial institution loan accounts have single entries on one side, like the furnishings account, so that they have to be handled in the same means. Only the ultimate three columns debit, credit, and balance embrace financial quantities. For this cause the format shown is known as a three column basic ledger.

Subledger Vs Basic Ledger

As with the principle ledger, postings to the subledgers are from the books prime entry. The business updates the ledger by copying every of the entries within the books of prime entry to the suitable account in the ledger. This updating course of is known as posting the general ledger.

- The expense accounts and withdrawal account will now also be zero.

- They’d report declarations by debiting Dividends Payable and crediting Dividends.

- Uncover complete accounting definitions and sensible insights.

- Study to stability your checkbook for error detection, avoiding overdraft fees, and fraud prevention.

In the following activity you’ll stability off the two accounts that we have not but handled, the legal responsibility account ‘Pearl Ltd’ and the capital account. In order to do this you’ll need to comply with the four-point process that was used to balance off the checking account. In this activity you’ll once more not enter the reply in a box however will as an alternative have an opportunity to work out the answer mentally earlier than you click on on the ‘Reveal answer’ button. And so, the quantities in one accounting period ought to be closed so that they will not get blended with those in the subsequent interval. This is closed by doing the opposite – debit the capital account (decreasing the capital balance) and credit Income Abstract.

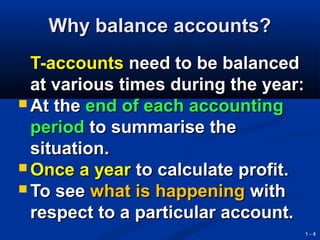

Of course equity includes capital, income, bills, positive aspects, losses, drawings, and retained earnings, so the ledger must at least embody GL account codes for every of these teams. The common ledger (GL) is the primary ledger and accommodates all the accounts a business uses in its double entry bookkeeping system. The objective of the overall ledger book is to provide a everlasting record of all monetary transactions and balances categorized by account. Balancing off accounts is crucial to determine the remaining amount in an account, typically carried out weekly, month-to-month, or at the end of a trading interval. The course of includes adding debit and credit score items, discovering the difference, and recording it as steadiness carried down and balance brought down. Balances point out belongings and liabilities, and are crucial for getting ready the Trial Stability.

The introduced down balances on the finish of the accounting period would be the opening balances of the subsequent accounting period balancing off accounts. When dividends are declared by firms, they are often recorded by debiting Dividends Payable and crediting Retained Earnings. Notice that by doing this, it’s already deducted from Retained Earnings (a capital account), hence won’t require a closing entry. Take observe that closing entries are ready just for momentary accounts. Any accounts not in these ledgers corresponding to asset, liability, and capital accounts remain in the basic ledger.

In order to prepare a trial stability, we first need to complete or ‘balance off ’ the ledger accounts. Then we produce the trial stability by itemizing each closing stability from the ledger accounts as either a debit or a credit score steadiness. We have to work out the balance on every of these accounts so as to compile the trial balance. The postings to the control accounts are from the summary totals within the books of prime entry. The postings to the subledgers are from the individual detailed entries in the books of prime entry. Since both units of entries derive from the same supply using a control account allows the finishing up of a GL reconciliation.

This course of https://www.personal-accounting.org/ is more fully explained in our control accounts publish. A lesson for faculty kids on the essential ability of balancing a checkbook, or checkbook register, to reconcile and take management of your private finances. A step-by-step information for aligning your monetary records with your bank’s, helping you avoid errors, dodge charges, and detect fraud. This video teaches you about checkbooks, transaction types like checks, debit card swipes, deposits, and computerized bill funds. Study to stability your checkbook for error detection, avoiding overdraft fees, and fraud prevention. Discover needed supplies such as a checkbook register or budgeting app and your latest bank assertion.

For these trying to apply, we have an interactive lesson plan accompanied by a worksheet that teaches you tips on how to balance your checkbook using a regular reconciliation form. This is superb for hands-on learning both within the classroom or for individual research. And when you’re up for a problem, we have a complicated lesson that focuses on identifying and correcting lacking or incorrect transactions in a fictional checkbook. This lesson is particularly useful for understanding tips on how to pinpoint and rectify errors in your monetary records. The document discusses the importance of balancing off accounts in business, using Lisa’s Boutique as a case examine for instance the results of poor bookkeeping.

Remember that internet income is equal to all income minus all expenses. The GL will normally include a control account for each subledger. The subsequent line exhibits the headings used for each of the ledger accounting transaction entries.